Al-Zaytouna Centre publishes, and offers for free download, the academic paper “Prospects of the Palestinian Authority Economic Performance for 2017–2018,” by Prof. Dr. Moein Muhammad Ragab. He is a well renowned professor of economics, and a former dean of the Faculty of Economics and Administrative Sciences at the Islamic University in Gaza.

The following is the executive summary in English, while for full Arabic paper Click Here

Executive Summary

The Israeli occupation remains the main and biggest obstacle to any economic activity or development in the areas controlled by the Palestinian Authority (PA). The Palestinian division has also cast a negative shadow on the economy.

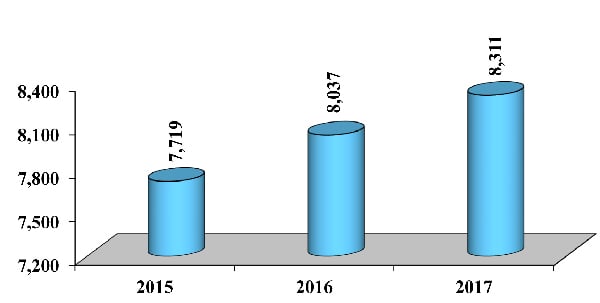

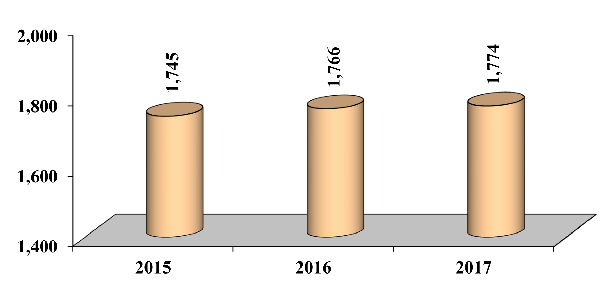

The conclusions regarding the economic forecast for 2017 and 2018 show a stagnation in the baseline scenario (non-pessimistic and non-optimistic) especially regarding the Gross Domestic Product (GDP) growth, which is expected to decrease from 3% to 2.7% for the two mentioned years, while the per-capita growth will be negative, 0% and –0.3% respectively.

Other indicators fluctuated between increasing and decreasing. Final consumption growth is expected to stand at 4% and 4.5%, and there is an expected increase in exports by 6% and 7%. This is a reflection of efforts to improve the investment climate, and an ambitious export strategy, with imports expected to decline by 3% and 2%, within a trend to replace imports and reduce the trade balance deficit.

Unemployment rates will remain at their high rates of 26% in 2017 and will decline in 2018 to 25%, with a large gap between the unemployment rates in the West Bank (WB) and Gaza Strip (GS), being in 2016 about 18% and 42% respectively.

The levels of poverty are expected to remain high reflecting the deprivation of income. In WB, it will be 16% and 15%, and in GS 40% and 42% in 2017–2018, respectively.

If the baseline scenario is this difficult, the pessimistic scenario is even more so, with GDP contracting from –1% to –3% and the per capita share from –4% to 6%, therefore leading to a further decline in the standard of living. Given that the chances of a pessimistic scenario materializing are strong and the risks are great, it is necessary to pay attention to their forecasts other than the less likely optimistic scenario. However, the odds for the optimistic scenario would increase in tandem with efforts made by Palestinians, especially in ending or limiting the division, which could lead to a relatively high growth in GDP to 6% and 8%, respectively, for the years 2017–2018, reflecting positively on per capita growth at 3% and 5% for the two consecutive years.

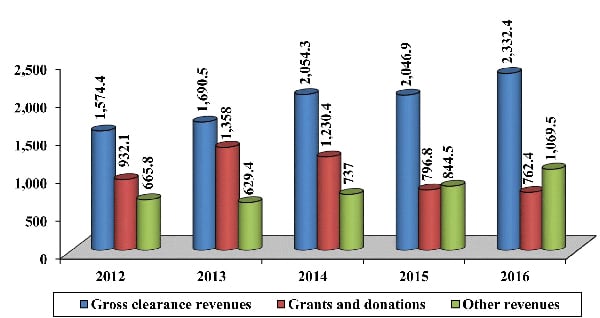

The above indicators generally reflect the overall PA performance, which was accompanied by chronic economic problems and a large deficit in the general budget, necessitating an over-reliance on external aid and domestic and foreign debt. Israel controls about 52% of the PA’s revenues collected from tax receipts; while about 27% of its revenues come from grants and foreign aid. This means that about three quarters of PA revenues come from sources that it does not control. In addition, the dilapidated infrastructure has affected the level of economic performance, increased suffering, and worsened the inability to implement rational economic policies. Not surprisingly, Israel represents a major obstacle to the liberation of the Palestinian economy from dependency, alongside the Palestinian division that has hindered the Palestinians from reaching a unified vision on future policies for economic development.

The large general budget deficit, the trade deficit, the increase in public debt and the decline in foreign aid, in addition to the high unemployment rates, represent the most prominent challenges facing the PA. In addition, the deterioration of infrastructure, the inadequate investment climate, and the insufficient allocation for research and development, reflect the nature and magnitude of these challenges.

The recommendations of this study call for putting these challenges at the forefront of attention of the competent authorities, without neglecting the implementation of policies to encourage national production. Restructuring the general budget to the extent that reduces the large deficit is a major demand as well, which would also have the added benefit of preparing society to phase out foreign aid. In addition, the Palestinians must reduce disparities in income levels among segments of society.

However, it is important to note that the main remedy for addressing the problems of the Palestinian economy lies in the elimination of the occupation. It is also important for the Palestinian economy under occupation to be a resistance economy, not a consumer economy.

Following are some charts that are discussed in detail in the Arabic Academic Paper:

GDP in PA Territories 2015–2017 at Constant Prices ($million)

GDP per Capita in PA Territories 2015–2017 at Constant Prices ($million)

Exports and Imports of the PA at Constant Prices ($million)

Donations, Gross Clearance Revenues and Other Revenues of the PA 2012–2016 ($million)

| Click here to download the arabic academic paper:

>> Academic Paper: Prospects of the Palestinian Authority Economic Performance for 2017–2018 … Prof. Dr. Moein Muhammad Ragab >> Academic Paper: Prospects of the Palestinian Authority Economic Performance for 2017–2018 … Prof. Dr. Moein Muhammad Ragab |

Al-Zaytouna Centre for Studies & Consultations, 8/6/2017

Leave A Comment